NTE - over 16 para for the s/s. Personally, I can't stand this stock just working out long for everyone, no lie, this is a runner, but 5 to 15 in a few months, e/r was sick, but .15 div not justifialbe enough, fair value seems like $12 to me. Either way, short the rush over 16 for the trade, just thinking outloud with the value stuff. 7 mil vol on the run to 15 earlier, only 2 mil today, vol is dying off, 7 mil buyers stayed quite, but its a factor.

BGFV - same pattern as NTE, looking for new 52's tomorrow. 13.72 was the b/o, closed very close to 14, wouldn't not expect a gap up over 14, then quick pull out the gate, I'd be long there and then we see it uptrend.

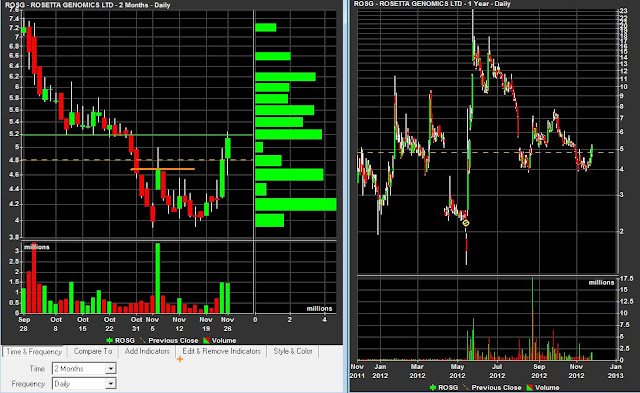

ROSG - crossed 5 and held, swinging long on this one, add'd today, looking for 6.5 tbh. They want to say 5.2 is the resistance, but all those longs are gone. Should blow through that tomorrow. Long bias, former runner as well, clear double bottom at 4, temp res at 5.2 and we run. Patience key.

MBI - short watch, rebounded too hard to hold it, over 9 has sellers.

AMRN - closed at a good spot today, 11.5 is a good long idea. 12 tgt.

ADY - last but not least. This one is breaking the downtrend line and needs vol, but should be a runner over 7+, long bias.