LNKD - they bot slideshare and also beat on q e/r and set guidance above. If it opens up weak south of the 115 area then I'd look for a long and a 52 week push at 122.69, if it opens strong I'd look to short and cover back at the teens. Ideally think this 52 week high pushes and then I'd be short, I think alot of resistance is at 110.

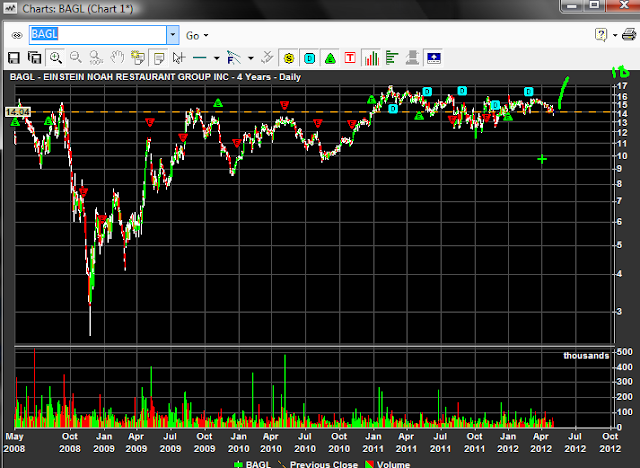

BAGL - Reports Q1 revenue was $104.9 mln, up from $101.2 mln. EPS was

$0.19,

up from $0.07 per share. Separately, the company said its

board authorized a review of strategic alternatives available to the company,

including a possible business combination or sale of the company. Prolly pulls to the 17 level and forms some support before trending higher. Really light vol on this one though, take note.

SPRD - Reports Q1 earnings of $0.57 per ADS, versus the Capital IQ consensus of

$0.40.

Revenues were $161.1

mln, versus the analysts' estimate of $158.31 mln. For Q2,

the company sees Q2 revenues of $170 mln - $175 mln, ahead of the Street

consensus of $164.62

mln. So every thing on the up and up, but I like the support at 15, any dips below as long as it consolidates and perks I'd look long for a kick back to resistance at 16-17, with 17+ area as breakout.

BODY - Reports Q1 revenue of $82.7 mln, just ahead of the analyst consensus of

$82 mln

on Thomson Reuters. EPS was $0.36, in line with expectations. For Q2, the

company expects revenue in the range of $80 to $82 mln and EPS of $0.26 to $0.28 per

share. The Street view is $87 mln in revenue and earnings of $0.36 per share. I think it goes to sub 19's before it finds support. I'd be short biased until that area.

VHC - sick move today, watching for short set up on any move back to highs or higher.

IL - coiling nicely down here at 5 and on the 5 cross today it looked stronger, may be ready.

FTK - I like this one for a pullback to support at 13 and lower possibly, short play on pops back to 14 fail or 14 and para.

Z - close to 52's 44.14

GMCR - on watch for the long, panic washout, 22's maybe.

FRIDAY, May 4

Extended-Hours Earnings: AES, AON, CBRX, DUK, EL, FSS, ITT, JOUT, NVAX, PPL,

SE, WPO, WCRX.

Economic Data: 8:30 a.m. Payrolls Data, Unemployment Rate.